Translate:

Healthcare Reform for Small Business

The Affordable Care Act (ACA) offers incentives, such as tax breaks and tax credits via the Small Business Health Options Program (SHOP), to small businesses with the equivalent of less than 25 full-time workers, making less than $50,000 in average annual wages, to help them provide health benefits to employees.

While the majority of employers and employees won’t pay any additional taxes under the ACA, there is an increase to the current Medicare part A tax for businesses and employees making over $200,000. There is also a requirement for employers with 50 full-time equivalent employees or more to offer health insurance to full-time workers or pay a penalty starting in 2015 / 2016.

The Employer Mandate

The ObamaCare Employer Mandate / Employer Penalty, originally set to begin in 2014, was delayed until 2015 / 2016. ObamaCare’s “employer mandate” is a requirement that all businesses with 50 or more full-time equivalent employees (FTE) provide health insurance to at least 95% of their full-time employees and dependents up to age 26, or pay a fee by 2016. Below we clarify how each aspect of the mandate affects employees and employers.

The employer mandate is officially part of the Employer Shared Responsibility Provision. Under the Affordable Care Act, the federal government, state governments, insurers, employers, and individuals are given shared responsibility to reform and improve the availability, quality, and affordability of Health Insurance Coverage in the United States.

Firms with 100 or more full-time equivalent employees (FTE) will need to insure at least 70% of their full-time workers by 2015 and 95% by 2016. Small businesses with 50-99 FTE will need to start insuring full-time workers by 2016. The mandate does not apply to employers with 49 or less FTE.

Employers with less than 25 FTE with average annual wages of less than $50,000 qualify for employer tax credits through ObamaCare’s SHOP. Those with 10 or less FTE with average annual wages of less than $20,000 qualify for the full credit of up to 50% of their share of employer premiums. To be eligible for a tax credit, the employer must contribute at least 50% of the total premium cost or 50% of a benchmark premium (second lowest cost Silver Plan in your state’s Marketplace).

If an employer doesn’t provide coverage, provides coverage that doesn’t offer minimum value, or provides coverage that is unaffordable, then they must make a per-employee, per-month “Employer Shared Responsibility Payment“. The IRS will provide the employer with a notice about the payment. Employers will not be required to include the Employer Shared Responsibility payment on any tax return that they file.

Guide For Small Businesses

Employer Shared Responsibility

The Affordable Care Act’s Employer Shared Responsibility (ESR) provision — often called “the Employer Mandate” or

“Play or Pay” — requires large employers to offer health coverage to their full-time workers or face a potential penalty.

Small employers with fewer than 50 full-time and full-time-equivalent employees are exempt. Play or Pay takes effect January 1, 2015, although special transition relief rules will allow some employers to delaycompliance for several months or into 2016.

The concept behind Play or Pay is simple: To play, the employer must offer health coverage to full-time employees that work on average 30 or more hours per week. Employers that fail to offer coverage, or fail to offer adequate coverage, will pay penalties if any full-time employees receive government subsidies to buy individual insurance through an Exchange (Marketplace).

The concept may be simple but the details are complicated. Is the employer a Large Employer and subject to Play or Pay? How are full-time employees dened? What type of coverage is adequate? When must coverage be offered? How are penalties calculated?

Play or Pay is a two-prong test that applies to Large Employers with 50 or more full-time employees (including full-time-equivalents):

Penalty A. First, does the employer offer basic health coverage to most full-time employees and their children? If not, the employer is at risk for a large penalty. On a monthly basis, Penalty “A” is equal to 1/12th of $2,000(2) times the number of Full-Time Employees (minus the first

80 such employees). and 30 employees for 2016.

Penalty B. For employers that pass the first prong without a penalty, the second test is whether the employer offers all full-time employees and their children affordable coverage providing minimum value. If not, the employer is at risk for a different (smaller) penalty. On a monthly basis, Penalty “B” is equal to 1/12th of $3,000(2) times the number of Full-Time Employees that receive subsidies due to employer’s failure to offer Affordable Minimum Value Coverage. However, Penalty “B” is limited to the amount that would be calculated under Penalty “A” (if “A” had applied).

The two penalty types — called “A” and “B” for the sections in the law — are designed in tandem so that employers that decide not to offer comprehensive coverage to all their full-time workers are still incentivized to offer at least some coverage to most workers. Penalties are triggered when full-time employees receive government subsidies to buy individual insurance through a Marketplace (Exchange) based on their income and lack of access to employer-sponsored coverage.

Employer Shared Responsibility Video

What is Minimum Value Coverage

A Health Plan meets minimum value if the plan’s share of the total average costs of covered services is at least 60%. In other words, it must meet the basic requirements of a plan sold on the health insurance marketplace.

If you purchase a group plan using the SHOP (Small Businesses Health Options Marketplace), it will qualify as having minimum value, so we strongly suggest using the SHOP. That being said, firms with over 100 full-time employees (50 in some States) can’t use the marketplace at the moment. Even if your firm can’t use the marketplace, you can use healthcare.gov to get an idea of what benefits and actuarial value bronze plans (the lowest-tier plan that provides minimum value) cover.

To determine whether other coverage meets minimum value, you can use the minimum value calculator provided by the U.S. Department of Health and Human Services. When you input certain information about the plan into the calculator (like deductibles and copayments), it will help you determine if the plan covers at least 60% of the total allowed costs of benefits provided under the plan.

What is Affordable Coverage

If an employee’s share of the premium costs for employee-only coverage (not the entire family) is more than 9.5% of their yearly household income, the coverage is not considered affordable.

Since you typically won’t know your employee’s household income, you can generally avoid a Shared Responsibility Payment for an employee if the employee’s share of the premium for employee-only coverage doesn’t exceed 9.5% of their wages for that year as reported on the employee’s W-2 form.

Here are three safe harbor methods for determining Affordability:

9.5% of an employee’s W-2 wages (reduced for any salary reductions under a 401(k) plan or cafeteria plan)

9.5% of an employee’s monthly wages (hourly rate x 130 hours per month)

9.5% of the Federal Poverty Level for a single individual

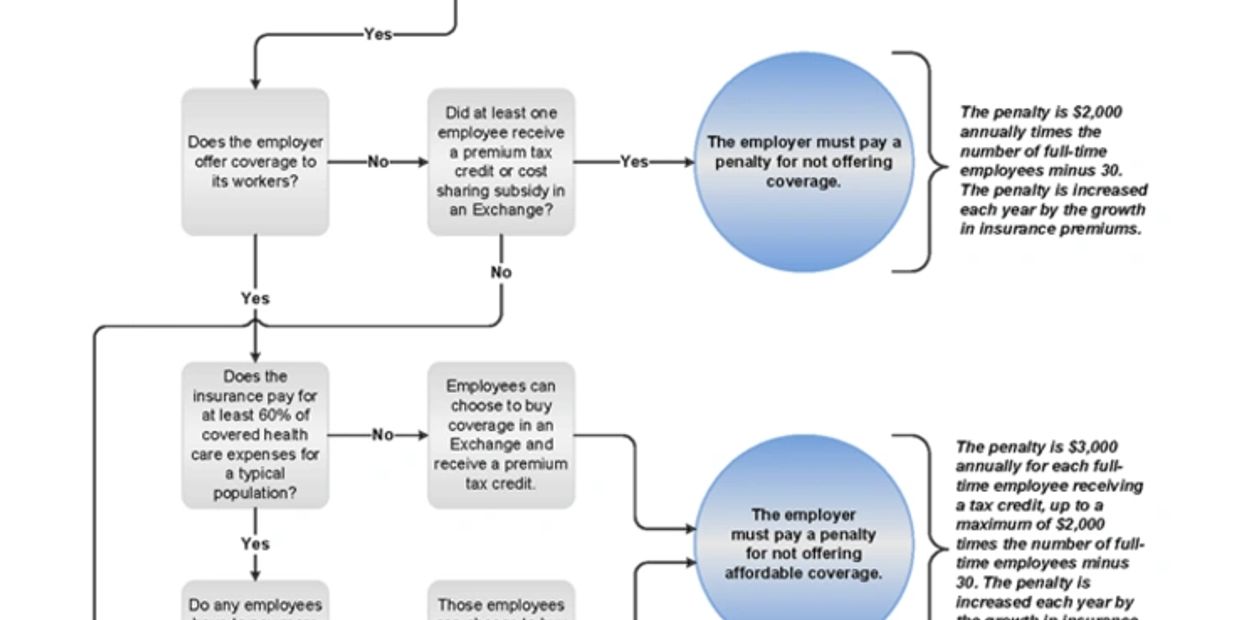

Flow Chart to the Employer Mandate

Subscribe

Sign up to hear from us about the latest Healthcare changes

Copyright © 2018 Supreme Insurance Group - All Rights Reserved.

Powered by GoDaddy